In a previous pair of 33N blog posts[1], we applied the idea of the “food desert” to banking in order to examine access to banks and banking services. But there are other types of companies that provide alternative services, such as the payday lenders[2], pawn shops, and check cashing companies. If banks are the “healthy” choice, we can think of these companies as the “fast food” restaurants of the banking sector. To explain that analogy: sometimes you need a quick meal on the go, and fast food fills that niche. But it’s not something you should eat every day. And yet, these alternative providers plug some of the holes in the banking system. For example, if you need to cash a check immediately instead of waiting for it to “clear” or if you need a quick loan on the order of a few hundred dollars, you’ll find these providers ready to help– for a fee, surely.[3] But you wouldn’t want them to be your lone service provider any more than you would want to eat “fast food” every day.

Writers about food deserts have coined a relatively new term: the food “swamp”. These are areas where fast food restaurants abound, but no healthier dining choices are accessible. So, how are these alternative financing providers located compared with traditional banks? And does Atlanta have any areas that would qualify as a bank “swamp”? To address these questions, we turn to data from BusinessWise, an Atlanta company that collects information on businesses our region[4] to assist their clients with business and lead development.

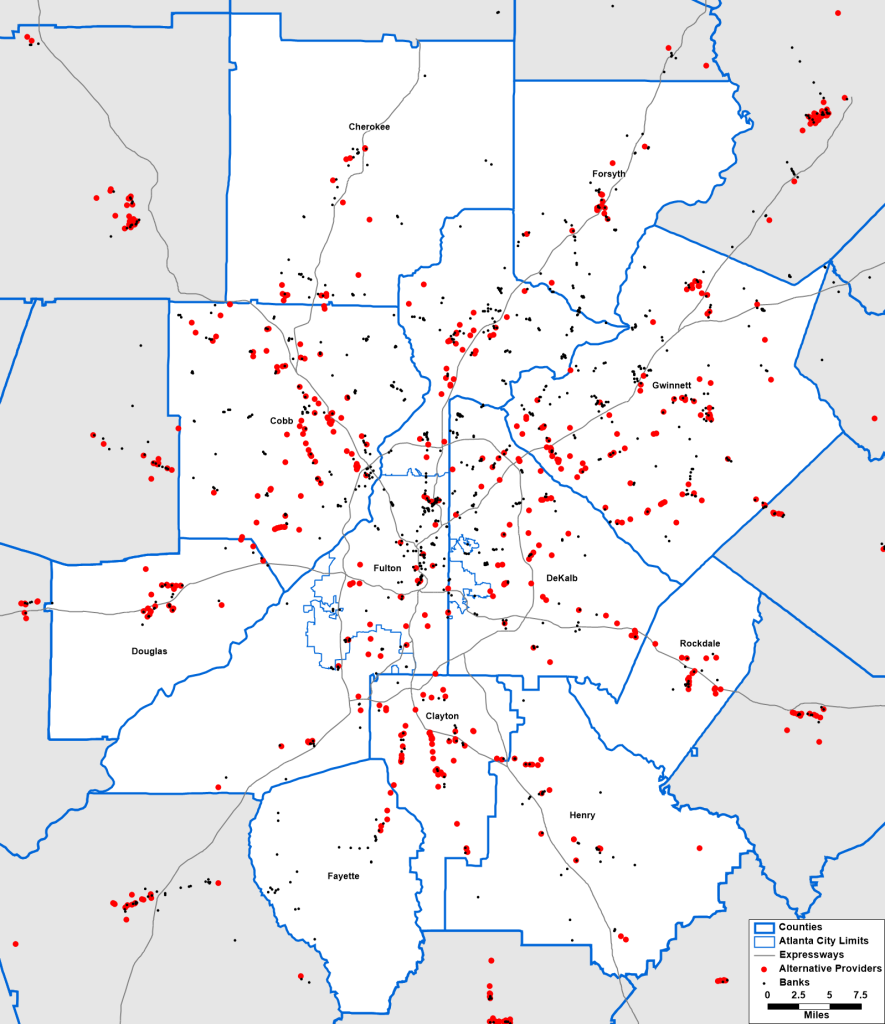

Figure 1 below shows the distribution of alternative banking service providers (5/) (represented as the larger red dots) around the 11-county ARC region, as compared with traditional banks ( shown as smaller black dots)(6/).

Figure 1: ARC 11-County Area–Banks and Alternative Provider Locations ( Source: BusinessWise, ARC RAD)

As the map above shows, banks are more spread out throughout the region, while the payday lenders and other alternative providers primarily cluster along certain commercial corridors.[7]

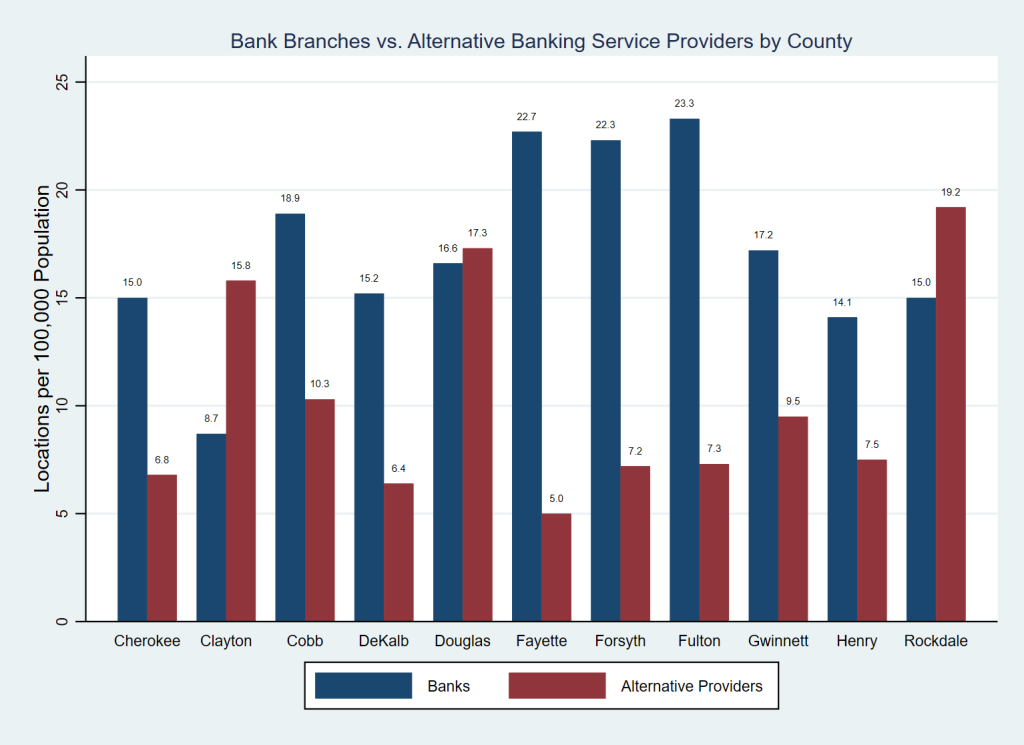

Figure 2 below offers another look at how banks and alternative providers are distributed throughout the region, this time as the number of locations per 100,000 people:[8]

Figure 2: Comparing Traditional and Alternative Providers by County in ARC 11 Counties (Source: BusinessWise, ARC RAD)

The above chart above shows that banks outnumber providers of alternative banking services by healthy margins in eight of the eleven counties in the ARC region. The difference is especially large in Fayette, Forsyth, and Fulton counties, where banks lead by a three-to-one margin or better. However, alternative providers outnumber banks in Clayton, Douglas, and Rockdale counties. Indeed, in Clayton County, which has the fewest banks per 100,000 people, payday lenders, pawn shops, and check cashing companies outnumber banks nearly two-to-one. Note: we will take a deeper dive into the question of the communities where these providers are located in a future blog post.

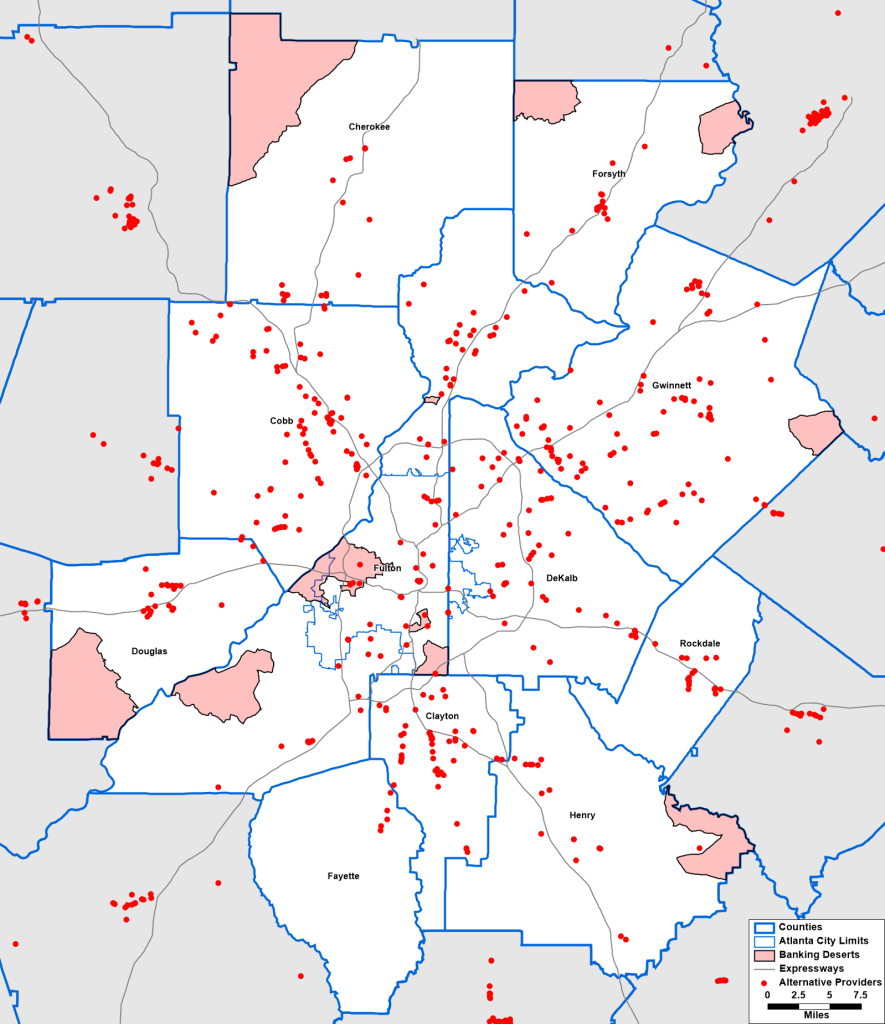

Figure 3 below revisits the banking deserts that we illustrated in those earlier blog posts [1/], only this time with the alternative service providers overlaid.

Figure 3: ARC 11-County Area–Banking Deserts and Alternative Provider Locations ( Source: BusinessWise, ARC RAD)

Figure 3 reveals that three of our banking deserts are, in fact, also banking swamps. This is especially true for the banking desert in west Atlanta, which is the home to six alternative providers, including three in a single strip mall

Footnotes/ Resources:

[1] See https://33n.atlantaregional.com/data-diversions/banking-deserts-and-banking-droughts-a-deeper-dive and https://33n.atlantaregional.com/data-diversions/the-decline-of-bank-branches-and-the-rise-of-atlanta-banking-deserts.

[2] Technically speaking, a payday loan is small short-term loan, usually due on the borrower’s next payday– hence the name (see https://www.consumerfinance.gov/ask-cfpb/what-is-a-payday-loan-en-1567/). Pure payday loans are not legal in Georgia, but licensed companies may still make similar high-cost loans in the form of installment loans of up to $3,000 for up to 36 1/2 months. Licensed companies are permitted to charge 10% interest, plus an origination fee of up to 8% of the first $600 of the loan and 4% of any additional amount, plus the actual cost of any premiums they may pay to insure the unsecured loan. We are using the term “payday loan” colloquially to refer to small, unsecured, high interest short-term loans.

[3] Lisa Servon of the University of Pennsylvania conducted research on the unbanked (people with no bank account) and underbanked (people with a bank account who also consume alternative financial services) populations. Her research found that some choose alternative services because they prefer and can budget around the known, predictable fee structures at these providers. This is more an indictment of the banking system more than praise for the alternative providers; she notes that a bank’s insufficient funds fee, is in effect, a type of short-term loan, whose APR exceeds that of a payday loan. So, while many view these alternative providers as predatory, it is necessary to recognize that many would be worse off if these providers were put out of business without any changes in the behavior of banks. To learn more, hear Professor Servon’s discuss her book, The Unbanking of America: How the New Middle Class Survives, at https://knowledge.wharton.upenn.edu/podcast/knowledge-at-wharton-podcast/the-payday-lending-crisis-and-the-middle-class/.

[4] While founded in Atlanta, BusinessWise also has operations in Charlotte and Dallas-Fort Worth. See https://www.businesswise.com/ to learn more about the company and its data offerings.

[5] BusinessWise provides the Standard Industrial Classification (SIC) Code for each business in its listing. To identify alternative banking service providers, we selected all businesses classified under SIC code 6141 (Personal Credit Institutions). To this list, we added businesses under SIC code 5932 (Used Merchandise Stores) with any of the following text strings in their company names: “Pawn” “Cash” “Title” “Loan” or “Lending”. This allowed us to capture pawn shops and companies like TitleMax while excluding thrift shops like Goodwill locations, which also fall under SIC code 5932. Data extracted from BusinessWise in October, 2023.

[6] Bank locations come from the 2022 FDIC Statement of Deposit data utilized in the previous blog posts.

[7]These include: Fairburn Road in Douglasville; Highway 41 from Cumberland Mall to Marietta in Cobb County; State Highway 85 from Riverdale to Fayetteville; Tara Boulevard for the length of Clayton County; Henry Boulevard in Stockbridge; US 78 in Mableton; Memorial Drive in DeKalb; Athens Highway through Gwinnett; Atlanta Road in Cumming; Jimmy Carter Boulevard in unincorporated Gwinnett; the Buford Highway corridor; and Roswell Road between Sandy Springs and Alpharetta.

[8] Population figures from the 2020 Decennial Census served as the denominator for these calculations.