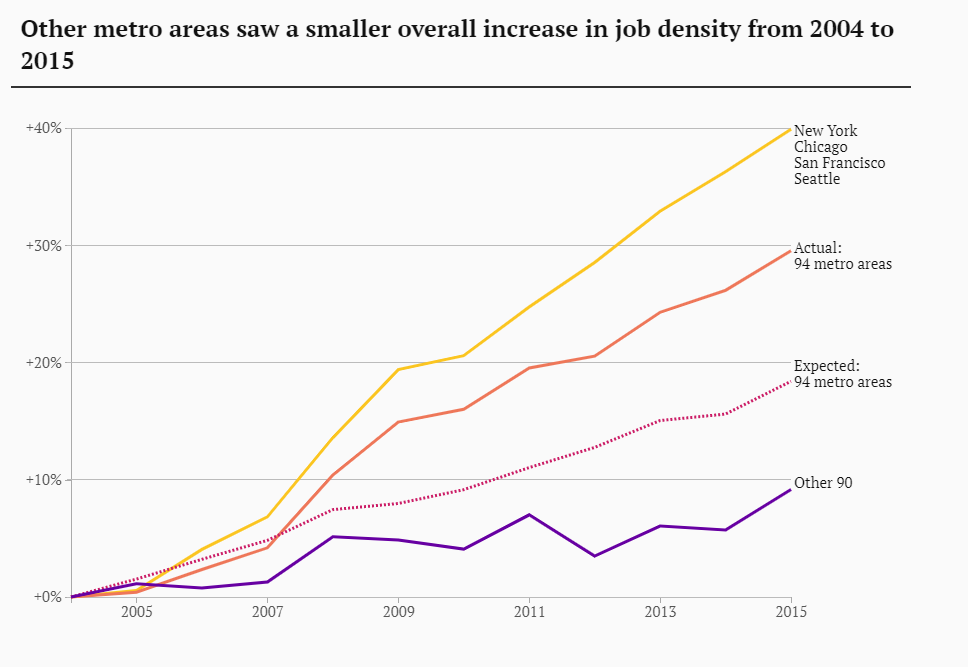

A new report released last month from Brookings’ Bass Center for Transformative Placemaking analyzed the concentration (or lack thereof) of jobs in America’s 94 major metro areas. The authors found that, on average, job density increased by almost 30 percent from 2004 to 2015. However, this was found to have been driven by the top four densest areas: New York, Chicago, San Francisco and Seattle.

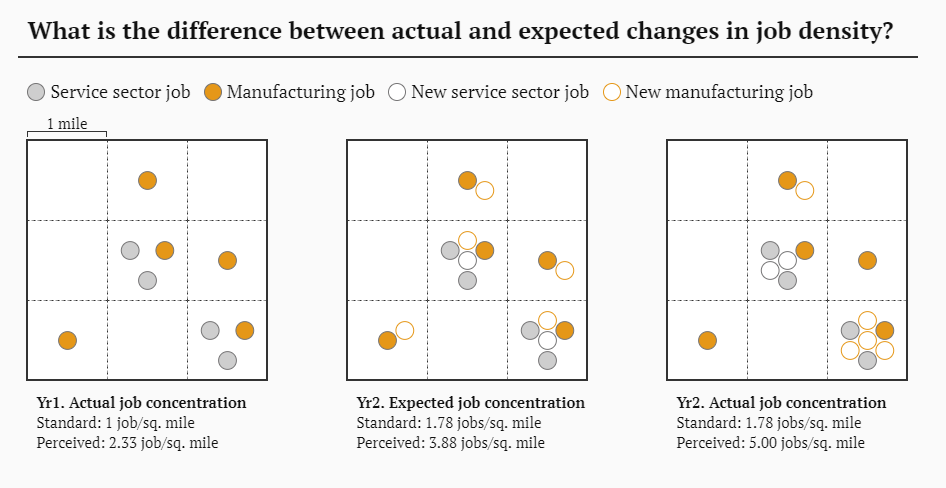

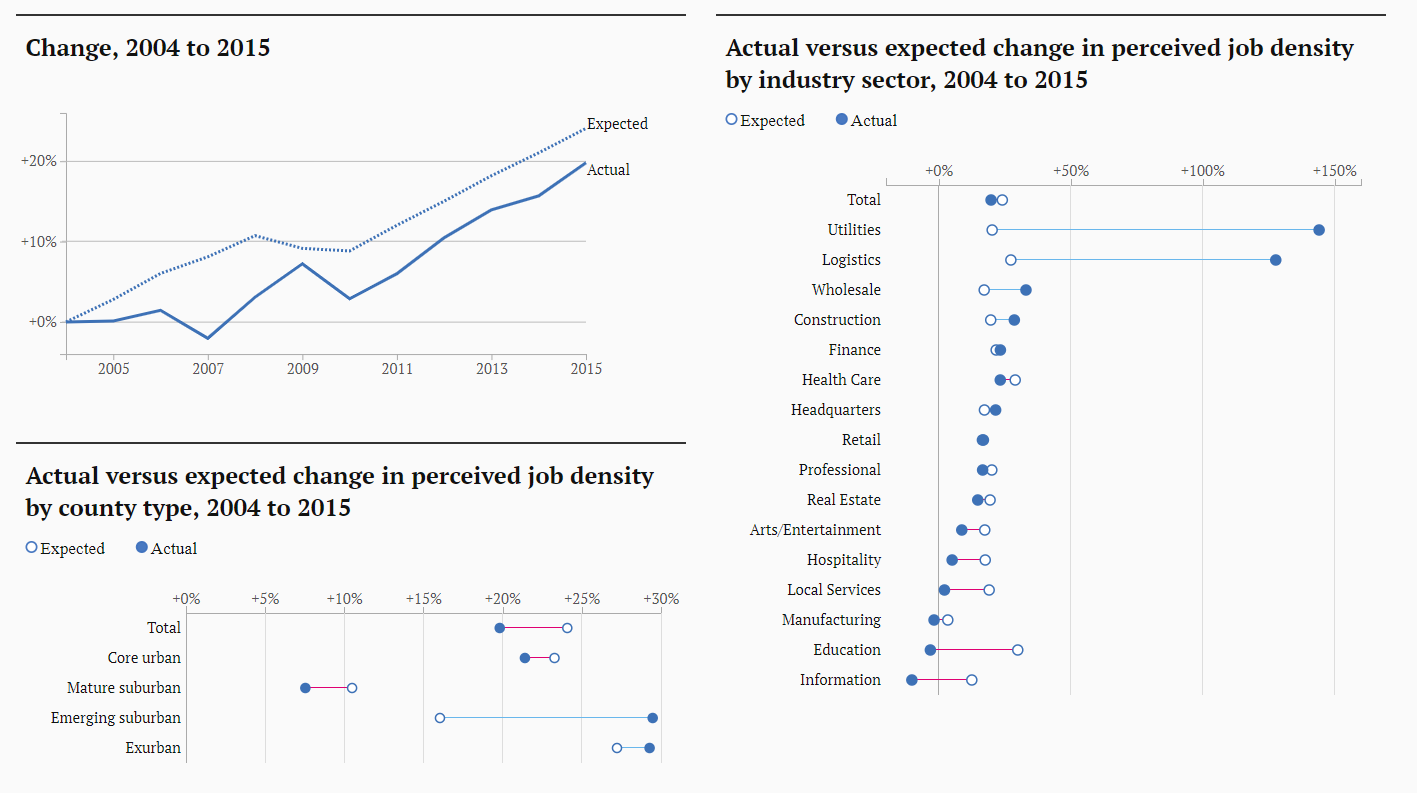

The analysis measured perceived job density, meaning that instead of calculating the number of jobs per square mile, the authors calculated the average number of jobs in the vicinity of each job. This better represents the density that people feel when in a concentrated business district. This difference can be very stark—Boise, Idaho, for example, has a standard density of 20 jobs per square mile, but a perceived density of 4,743 jobs per square mile. The expected change versus actual change was also compared in each metro area. This analysis is able to show shifts in amount and location of job concentration.

Where does Atlanta fit in?

Atlanta saw a job density increase 20 percent between 2004 to 2015. This is a larger increase than roughly 60 percent of the other metro areas. The increase fell a bit short of the expected 25 percent. Carrying Atlanta’s density increase, by far, were the Utilities and Logistics industries, as well as the “emerging suburban” counties. This underscores one of the key findings of the report: While job density is, on average, increasing, it increases in very different ways both among and within America’s metro areas.

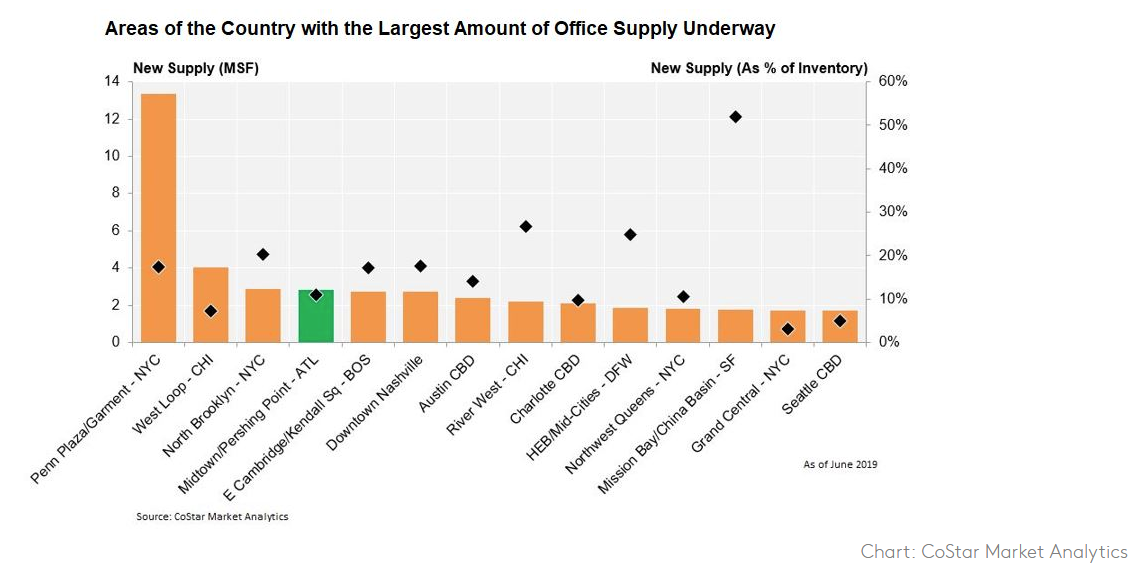

While the Brookings report measured actual jobs using Census employment data, another way to look at the future of central business districts in our region is to analyze new office construction. The commercial real estate research group CoStar reported last week that Midtown Atlanta is the country’s fourth most active office construction area (this definition of “Midtown” includes properties ranging from 725 Ponce, on the Eastside Beltline, to T3 in Atlantic Station). The submarket reportedly has a record high of 2.8 million square feet of office space in progress.

To explore the Brookings report further, visit: