Job loss, very sadly but not all unsurprisingly, is just the beginning of the story of COVID-19 suffering. Housing is the primary use of most households’ income, and as we all know a key social challenge is housing affordability. This affordability is tenuous for so many to begin with, and has been a primary focus of the Atlanta Regional Commission’s (ARC’s) Regional Housing Strategy. The ARC strategy contains clear evidence that housing affordability is much more of a challenge for the low-income renter than for others, and that these households tend to be minority-headed. So these households would be most vulnerable — in terms of housing costs, to short-term stress on their jobs — from any source, but right now from the impacts of a virus on our economy and society.

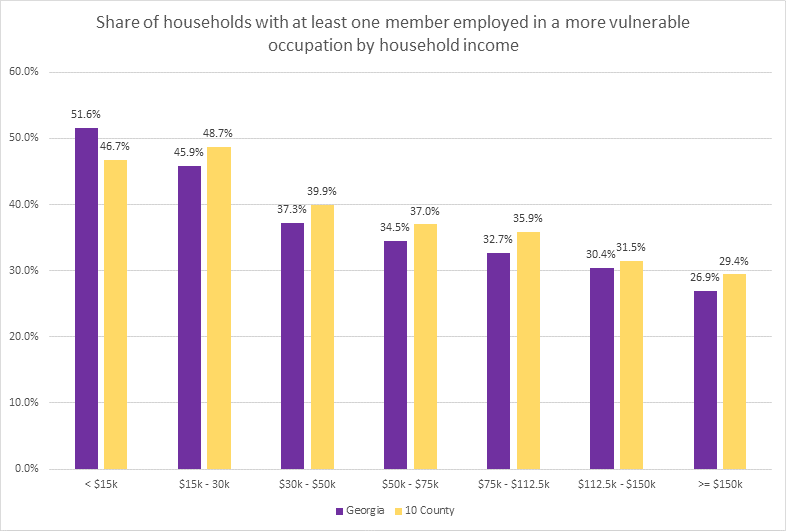

Recent work by the New York University’s Furman Center begins to frame this pending affordability issue for occupations vulnerable to more immediate COVID-19 related job loss. You can check out the Furman work here. Building on the example and methodology of this initial Furman study, we used their definitions of vulnerable occupations to take a preliminary look at similar data for Georgia and the 10-county Atlanta Regional Commission area. The first chart below shows that — as in the Furman work — most of the COVID-vulnerable state and regional occupations fall within lower-income household categories.

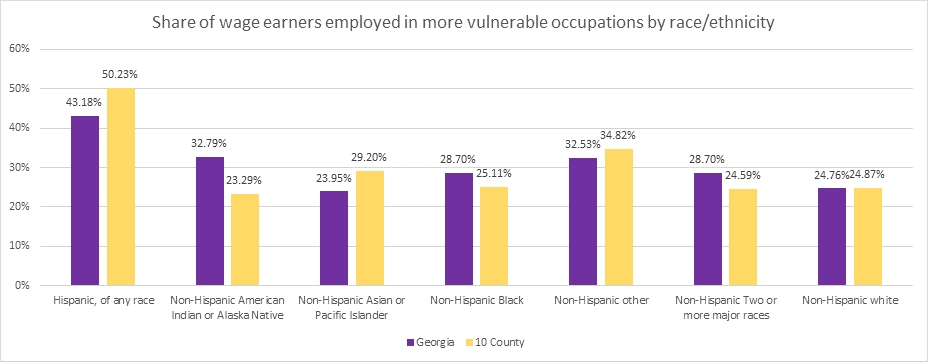

The second chart below shows vulnerable occupations by race and ethnicity. Vulnerable occupations in the state and in the region, are much more likely to be filled by Hispanic workers than any other race/ ethnicity. In fact, within the 10-county area, over half of the jobs held by Hispanic workers are in vulnerable occupations. There is not much variation between the other categories, at around 25-35% of jobs across the state and the region.

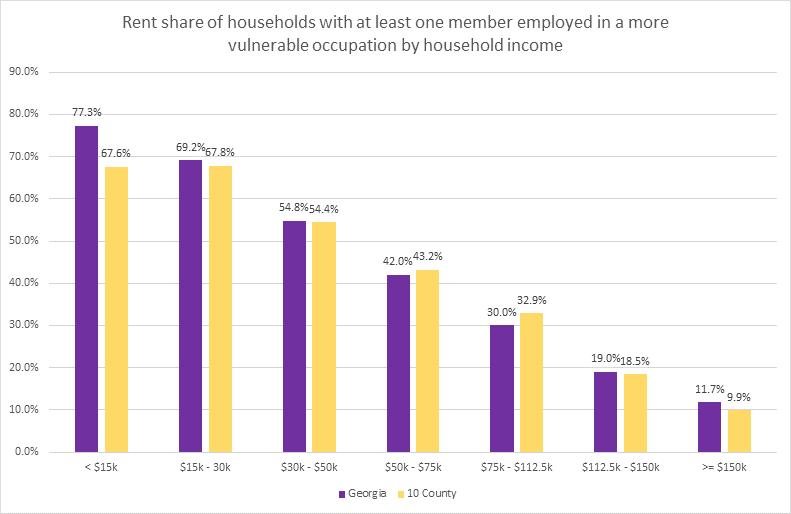

Finally, on the third chart below, most of the vulnerable occupation jobs are not only held by the low-income, but those households (strongly) tend to be renter households. Well over 60% of households earning less than $50,000, for both the state and the 10-county area, have at least one worker employed in vulnerable occupations.

The CARES Act does contain some temporary relief measures for homeowners and renters. But it remains to be seen if this relief will be anything more than a short reprieve for households that, already stressed greatly by housing costs, may haver to deal with job loss on top of that. And the CARES Act measures pertain only to the federal-subsidized housing market, not to low-rent units in the private sector.

Watch this blog for more to come on COVID-19 housing impacts, as the stimuli impacts are felt (or not), the new data flow in, and the market impacts become clearer.