Neighborhood Nexus (which ARC is a core partner in) recently put up some interesting new data – the distribution of small business loans. The map, as you can see, shows the uneven distribution of commercial lending to small businesses. But this is actually a familiar story.

Before we tell you why this familiar, first a little background information on the data. They come from the Community Reinvestment Act (CRA), which requires banks and other lending institutions of a certain size to report where their loans are going. The loans reported are for less than $1 million. The idea was to assess how well local lending institutions are meeting the needs of the communities they serve. Here is a good primer on the CRA, along with some important caveats.

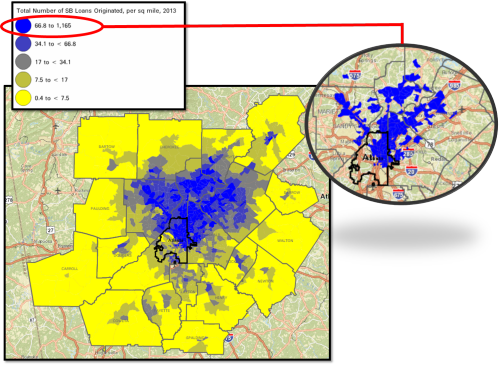

Small Business Loans per Square Mile, 2013

The blues show the heaviest concentrations of where small business loans are going, with the dark blues representing the most small business loans per square mile. The inset shows the top neighborhoods (the highest 20 percent), which are all located above I-20.

At first glance, you might assume that the Atlanta region’s banks aren’t meeting community needs since the majority of loans are concentrated in such a relatively small area. But it’s not as simple as that. Much of the region’s commercial assets are concentrated in those “blue areas” seen on the map. So let’s take a closer look.

We isolated the top 20 percent of neighborhoods (census tracts) for small business lending activity. (These are the areas highlighted in dark blue in the inset of the above map.) These areas total about 4.6 percent of the region’s land area, but represent:

- 36 percent of the region’s small business loans

- 42 percent of the region’s jobs

- 17 percent of the region’s population

So, there is a reason that small business lending activity is so heavily concentrated in these northern neighborhoods – it where the jobs and overall business activity are located. And it is essentially the same pattern we see in mapping the data from the CRA’s cousin, the Home Mortgage Disclosure Act (HMDA), which tracks mortgage lending activity by neighborhood.

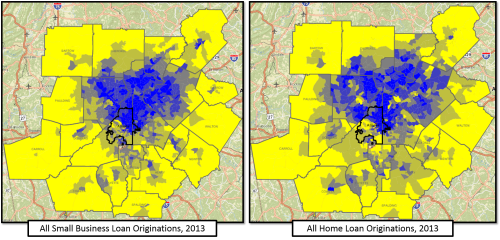

Comparing the Distribution of Small Business and Mortgage Loans

The two maps look pretty similar, don’t they? It’s obvious that a more even distribution of overall lending activity would be beneficial for the whole region, but as of now, investment is concentrated where the wealth and jobs are.

To make your own maps of small business lending in the Atlanta region on Neighborhood Nexus (or choose from hundreds of other variables), click here, then click on the header in the Color Legend and scroll down to the “Small Business Loans” folder.